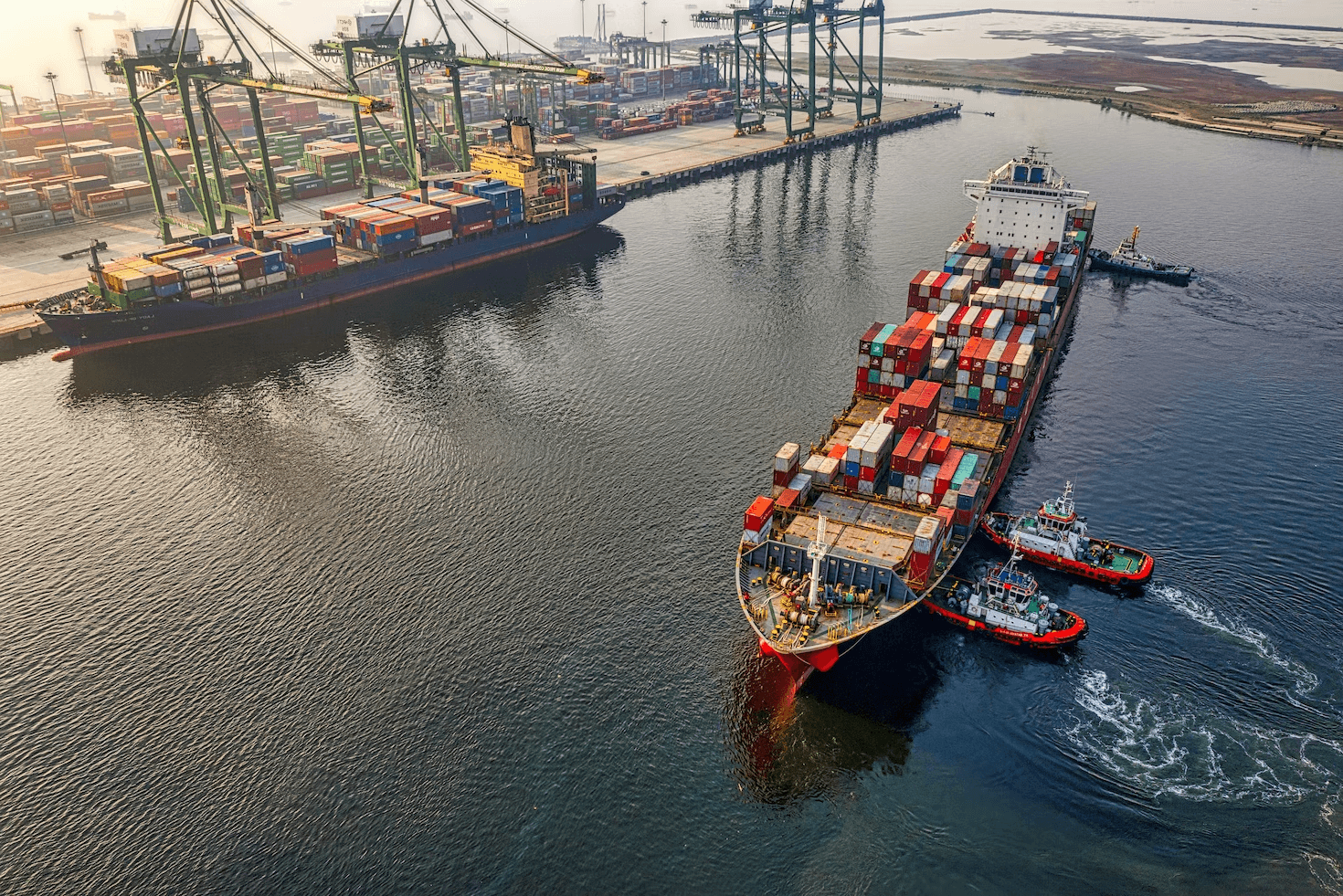

YCD News – Congestion at major U.S. container ports has largely disappeared as import levels have declined amid an economy fraught with uncertainty, according to the latest monthly Global Port Tracker released by the U.S. Retail Federation and Hackett Associates.

The report found that while the volume of imported cargo at major U.S. container ports is rebounding from a near three-year low in February, imports are expected to remain well below last year’s levels through the fall.

Jonathan Gold, vice president of supply chain and customs policy at NRF, said, “Americans are still spending, and retail sales are expected to increase this year, but without the explosive demand of the past two years.”

Jonathan Gold warned that while port congestion has subsided, other supply chain challenges remain, from a shortage of truck drivers to getting empty containers back to the dock.

On a positive note, negotiations are underway between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA), and an agreement may soon be reached between the two parties.

The continuing economic uncertainty, including high inflation, Fed rate hikes and Silicon Valley bank failures, will have a significant impact on the import trade, said Ben Hackett, founder of the Hackett Association.

Imports have been falling in most ports since the end of last year, and the decline in Chinese exports underscores the slowdown in demand for consumer goods,” he said. We forecast a further increase in import declines in the first half of this year. Import volumes will remain below recent levels until inflation and inventory surpluses are reduced.”

The report showed that U.S. ports handled 1.62 million TEUs in March, up 5% from February but down 30.6% from a year ago, with imports falling to their lowest level since May 2020.

Ports have not yet reported data for April, but Global Port Tracker forecasts 1.73 million TEUs for the month, down 23.4 percent from a year ago. 1.83 million TEUs are expected in May, down 23.5 percent from 2.4 million TEUs last year and the lowest number of imported containers in a single month.

Global Port Tracker also forecasts that the first half of 2023 is expected to be 10.4 million TEUs, down 22.8% year-on-year; the third quarter of 2023 is expected to be 6 million TEUs, down 7.2% year-on-year; and the first nine months of 2023 is expected to be 16.5 million TEUs, down 17.8% year-on-year.

YCD understands that total U.S. imports for the full year 2022 will be 25.5 million TEUs, down 1.2% from the annual record of 25.8 million TEUs set in 2021.

Staff furloughs as demand drops! FedEx Freight streamlines transportation network closing 29 locations!

FedEx Freight is closing 29 locations in its network and implementing another round of temporary furloughs as demand continues to decline. Operations in the affected areas will be consolidated to other locations beginning Aug. 13, according to an e-mailed statement.

“We continually review our network to ensure we have the right design in place to respond to changing market dynamics,” FedEx Freight said in a statement. “Through this process, we have identified opportunities to consolidate operations across multiple locations to improve customer service and increase efficiency through fewer touch points while reducing our cost of service.”

FedEx Freight’s statement did not specify what types of locations would be affected by the consolidation, but the company currently has about 400 service centers in its network, according to FedEx’s website. It didn’t specify how many employees would be affected by the decision, but said the department helped them “find other open positions whenever possible.”

The furloughs “for certain job categories” will begin May 28, immediately following the furloughs that began in March. All employees on furlough will be recalled on or before Aug. 25, and their health benefits will be maintained. FedEx noted that it will offer eligible employees the opportunity to permanently transfer to other markets where there is a hiring need.

FedEx Freight, along with other FedEx divisions, has been cutting costs and streamlining its network in the face of declining demand. For the quarter ended Feb. 28, revenue in the freight division fell 3 percent year-over-year as average daily shipments plunged 12 percent. However, reductions in operating expenses helped the company’s operating income rise 15 percent year over year.

“Going forward, FedEx Freight will continue to strategically invest in network capacity to support business growth and meet customer demand,” the company said in a statement, YCD learned. “FedEx Express continues to maintain normal operations and provide the essential services our customers depend on.”