Amazon restarted shipping services (Amazon Shipping), in the short term, will be from the small, e-commerce-oriented service providers to capture the share; and in the long term, the future and FedEx, UPS head-to-head, may also be just a matter of time.

Amazon relaunches shipping service, starting a new chapter?

YCD News – In late August, global e-commerce giant Amazon announced the official relaunch of its Amazon Freight service, which may subsequently compete directly with FedEx and UPS. Some industry experts believe that this is both beneficial and potentially risky for shippers who are considering ground express services.

According to Amazon’s official website, this Amazon Freight service provides Amazon sellers with delivery between the 48 states in the contiguous United States, with a delivery time of 2-5 business days, and also applies to orders from non-Amazon channels. Additionally, this delivery service promises to offer direct pricing with no additional surcharges, and there is also a swift claims resolution process. Parcel industry observers say this could appeal to small and medium-sized businesses as a strong alternative to other couriers.

In an emailed statement, Amazon spokeswoman Olivia Connors said, “We’re always working to develop new ways to support sellers on Amazon. The Amazon Freight service is another fast, cost-effective, and efficient alternative to shipping to our customers. This service has been in place for some time previously and has received positive feedback, so now we’re making it available to even more sellers.”

Originally launched in 2018, Amazon Shipping is positioned as a premium ground shipping service that is economically priced for delivery within 1-5 business days anywhere in the U.S. It had covered eight cities; Seattle, Los Angeles, Chicago, Detroit, Cincinnati, Dallas and Baltimore.

According to Trevor Altman, founder and board member of Shipware, a San Diego-based auditing and parcel consulting services firm, the cities were all close to major Amazon hubs or sorting centers, and packages were either placed on shipping lines next to the nearest sorting center or on routes to the delivery location.

At the time, the service was focused on building logistical capacity throughout the logistics process, of which transportation costs were a key component of the service. Amazon has also stated that this cost is expected to increase due to its business model and hopes to reduce costs by becoming more efficient in the transportation area.

Trevor Altman mentioned that the most noticeable change in this now relaunched freight service compared to the previous shipping model is that there are no significant cities for pickup and it is no longer an invitation-only program. However, the logic and business case for shipping remains the same.

Initially, Amazon’s logic for launching the shipping service was largely based on the fact that they already had trucks picking up Amazon packages in a number of locations, and those trucks were parked close to FedEx or UPS trucks. And with FedEx and UPS, Amazon usually has extra capacity in its trucks, as does its entire logistics network. As a result, it’s very easy for Amazon to make this profitable decision to maximize their own capacity and effortlessly pick up packages from their competitors.

Another thing that remains the same is that the service is still available to Amazon e-commerce customers and offers offline service by receiving and dropping off packages in Amazon’s logistics network. Amazon now has nationwide coverage of the U.S. for that service, with the ability to receive packages from any location. This is a major operational leap as they have allocated the appropriate resources for each customer.

For the shipping service, Amazon has only posted a handful of details on their website. However, industry observers say that in the short term, the service appears to be aimed only at small and medium-sized businesses. The reason is that Amazon Freight advertises “simple rates,” which is attractive to smaller merchants, who often don’t have the in-house expertise to understand the nuances of a package shipping contract with FedEx or UPS.

Caleb Nelson, chief growth officer and co-founder of logistics software provider Sifted, said that if the rates are as straightforward as Amazon claims, some shippers may be willing to accept up to five days of transit time and shift some of their FedEx and UPS volume. And the lack of a residential delivery surcharge is also a major advantage, a huge win for e-commerce businesses that will dramatically reduce costs.

For large corporate shippers, on the other hand, experts point out that Amazon Freight Services may have a hard time attracting such customers, with potential concerns including:

- if the package is moved to Amazon Freight, then it may lose the discounts given by other carriers based on the volume of the shipment.

- how is Amazon going to handle deliveries for this service during periods of tight shipping capacity, such as holidays or Prime Day promotions, when their orders may conflict with Amazon’s e-commerce orders?

- the service itself will not be able to reach the entire U.S. population. Amazon has also said it will use the United States Postal Service (USPS) to cover all delivery destinations for the service.

- if the heat is off, will Amazon cancel the service as a result?

But in any case, with the capacity constraints of the epidemic era a thing of the past, the relaunch of the shipping service will help Amazon to make extra profits from its expensive and vast network, and also means that it opens up a new chapter in the parcel shipping space, and could have an even bigger impact on the existing courier service providers.

As Shipware president Nathan Hughes emphasized, this is not a test or an experiment for Amazon, but a real strategic expansion of the service in the market.

Can Amazon compete with FedEx, UPS?

First, a look at a set of numerical statistics:

1,285: According to MWPVL International, as of the first quarter of 2023, Amazon has 1,285 active facilities in its U.S. distribution network.

231: The number of U.S. facilities Amazon has planned for the future will be 231, MWPVL International said.

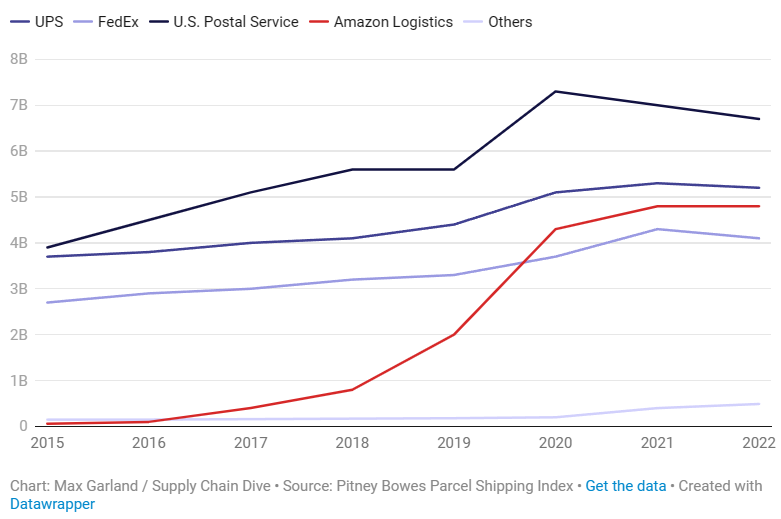

23%: according to the Pitney Bowes Parcel Shipping Index, Amazon holds the third largest market share in terms of U.S. package volume at 23% in 2022, behind the U.S. Postal Service and UPS.

4.1 billion: the number of items sold by Amazon U.S. sellers in 2022 is >4.1 billion, according to Amazon.com.

Combining the numbers above, Shipware President Nathan Hughes believes that a fulfillment network and unit volume of this size is a key factor in how experts believe Amazon’s emerging freight service can pose a threat to FedEx and United UPS.

Currently, FedEx and UPS are able to dominate the parcel delivery space largely on the back of their respective massive network infrastructures, including warehouses, trucks, airplanes, and crews delivering packages in the U.S. and elsewhere, which has allowed the two companies to build barriers to entry that almost no other company can match.

And Amazon is one of the few companies expected to break that barrier. That’s because delivery-wise, the e-commerce giant in already a formidable challenger. According to Pitney Bowes’ Parcel Shipping Index, Amazon handled 4.8 billion deliveries last year, already surpassing FedEx in terms of annual deliveries, and in 2019, it will handle less than half that number.

Caleb Nelson also said about this, “Unlike before the epidemic, Amazon is now a huge force.”

The Wall Street Journal has also reported that Amazon terminated its contract with FedEx just a year and a half after launching the service in 2018. Amazon is increasingly seen as a major competitive threat by FedEx due to its growing logistics network. Additionally, Amazon accounts for about 11% of UPS’s 2022 revenue.

Jerry Hempstead, president of Hempstead Consulting in Orlando, also said that if anyone looks at the industry’s publicly available data on parcels, they’ll see that in the U.S., the market for UPS, FedEx, and USPS is shrinking. Demand for Amazon, and Amazon’s use of artificial intelligence to bundle orders to one consumer, has freed up network capacity for these giants. Amazon’s return to the market as a competitor will put additional pressure on UPS, FedEx. Shippers’ bargaining power is also returning.

It can be said that the present is in the early stages of the evolution of Amazon’s freight service, and it is only a matter of time whether Amazon will become a competitor of FedEx and UPS in the future.

However, some experts pointed out that although Amazon launched the Amazon and external orders covering the “last kilometer” end delivery service, and ultimately how to deal with the competition with traditional courier giants, has not yet given a comprehensive answer.

In recent years, Amazon has gradually reduced its reliance on UPS, but still need to use UPS to a large extent to complete some of the deliveries, and now the launch of the freight service may threaten the volume of goods out of UPS. MWPVL’s Wulfraat said: “Amazon must now be careful, because they are still through the UPS delivery of a considerable amount of shipments.”

In the short term, Amazon Freight is unlikely to become a legitimate competitor to FedEx and United Parcel Service because of the barriers to attracting corporate shippers, said Ninaad Acharya, co-founder and CEO of Fulfillment IQ. Instead, as it builds a base strong enough to rival the express giants, Amazon will take share from smaller, e-commerce-focused providers such as Pitney Bowes and DHL eCommerce.Therefore, absolutely nothing should be underestimated in any move by Amazon, as many have already suffered from it.

Another parcel expert, Rick Watson, founder and CEO of RMW Commerce Consulting in New York, agrees: whenever Amazon makes any moves in the market, it needs to be watched closely. Currently, the parcel shipping market is very competitive. There is more supply than demand, more facilities than demand, and more service than demand, which to me suggests that consolidation in the market could happen and larger players will win market share. It’s important to note that Amazon doesn’t operate a truly independent transportation service. It’s a retail marketplace with holdings that provides transportation services and is able to provide infrastructure to others at marginal cost. At this point it appears that Amazon is picking up larger shipper contracts that are not available to common shippers. Overall, I see this as the first of many moves by Amazon to open up its transportation network to its most profitable customers.

In addition, Watson explains that Amazon has what he sees as the “antidote to trust” – price, service level and patience – three factors that many companies lack. Amazon will focus on what it’s doing right now until the results are in.