YCD News – With inflation, Americans also love to buy cheap goods, and Temu and Shein are working hard to win over young American consumers. Both e-commerce platforms use ultra-low price strategy to attract consumers, but in different ways.

Shein mainly sells fashionable women’s clothing. In contrast, Temu has a wider variety of products, including not only apparel, but also home furnishings, auto accessories, electronics and musical instruments.

What’s the same is that both Temu and Shein’s target audience is Gen Z consumers. It is worth noting that the competition between the two parties has been heating up in recent months, with each filing lawsuits against the other, accusing the other of unfair business practices.

Temu overtakes Shein as US e-commerce landscape shifts

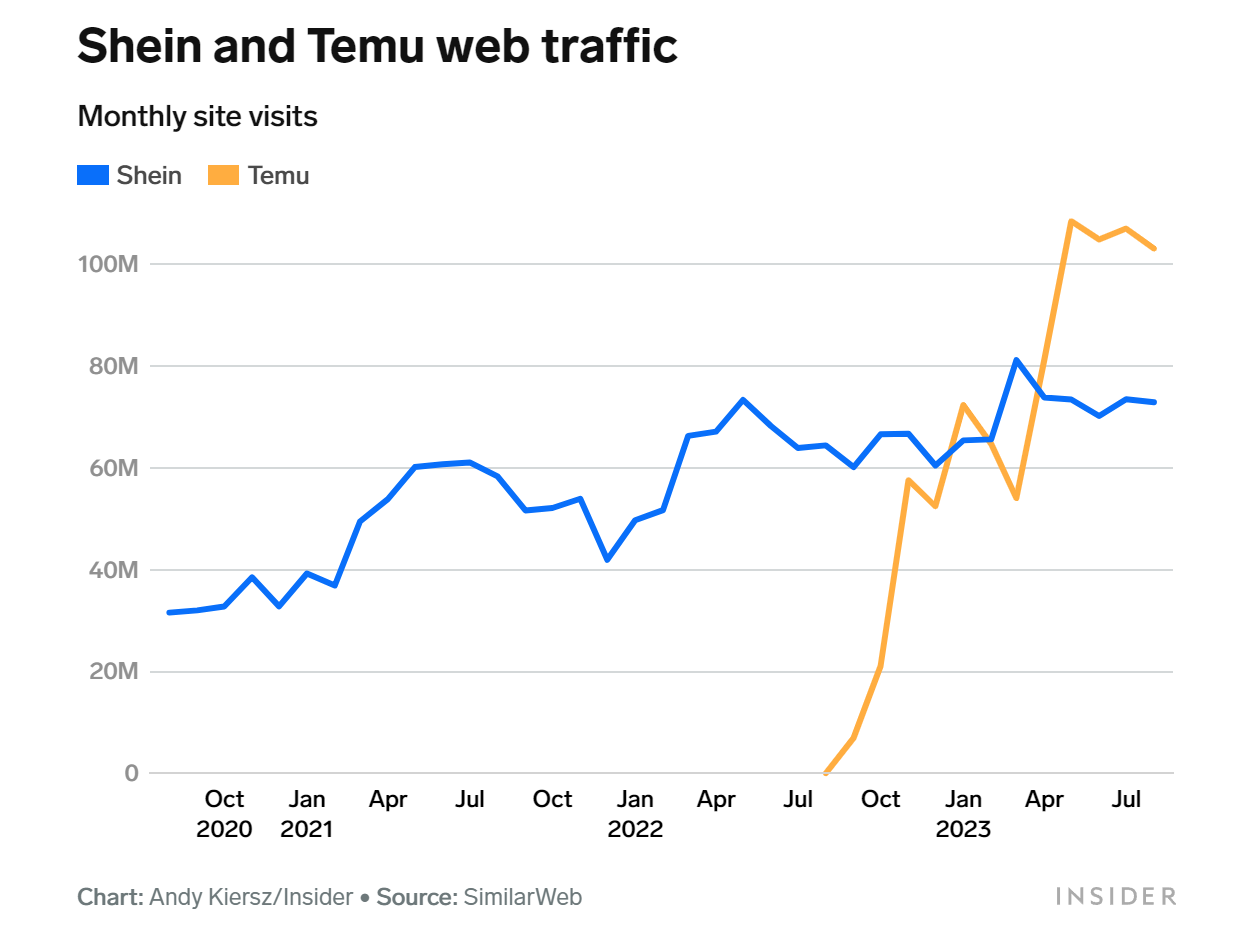

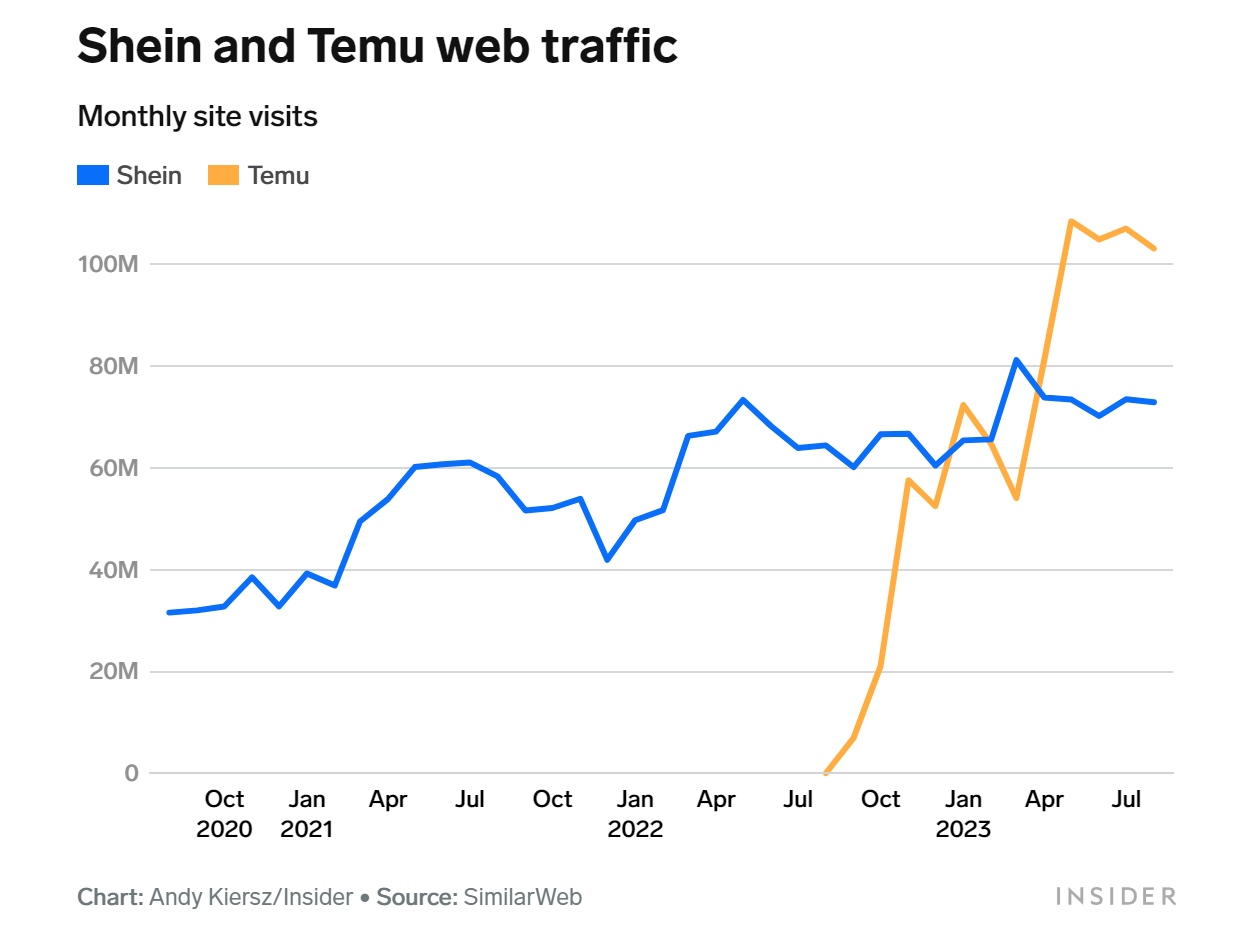

Although Temu only launched in the U.S. in September 2022, it has already surpassed Shein in terms of both website traffic and purchased visits, according to Similarweb.

In terms of website traffic, Temu has been higher than Shein since April of this year.In August of this year, Temu had 103.03M website traffic compared to Shein’s 72.87M.

In terms of purchase visits, Temu (1.43M) managed to overtake Shein (1.27) in May this year. In August this year, Temu’s purchase visits amounted to 1.88M, compared to Shein’s 1.19M. (Purchase visits are the total number of visits to a customer’s purchase page)

Advertising is a big reason for Temu’s traffic growth. Temu spends close to $500 million per fiscal quarter on marketing and promotions, including social media, display advertising and paid search, according to estimates by analysts at UBS.

Despite Temu’s rapid growth, its percentage of direct and organic search-driven web traffic is still lower than the industry average and significantly lower than Amazon’s, according to a research note published by UBS analysts. This means that Temu is not yet the preferred online shopping channel for U.S. consumers. However, it’s worth noting that Temu’s user retention rates are nearly identical to Shein’s levels.

Both Temu and Shein have a long way to go before overtaking Amazon

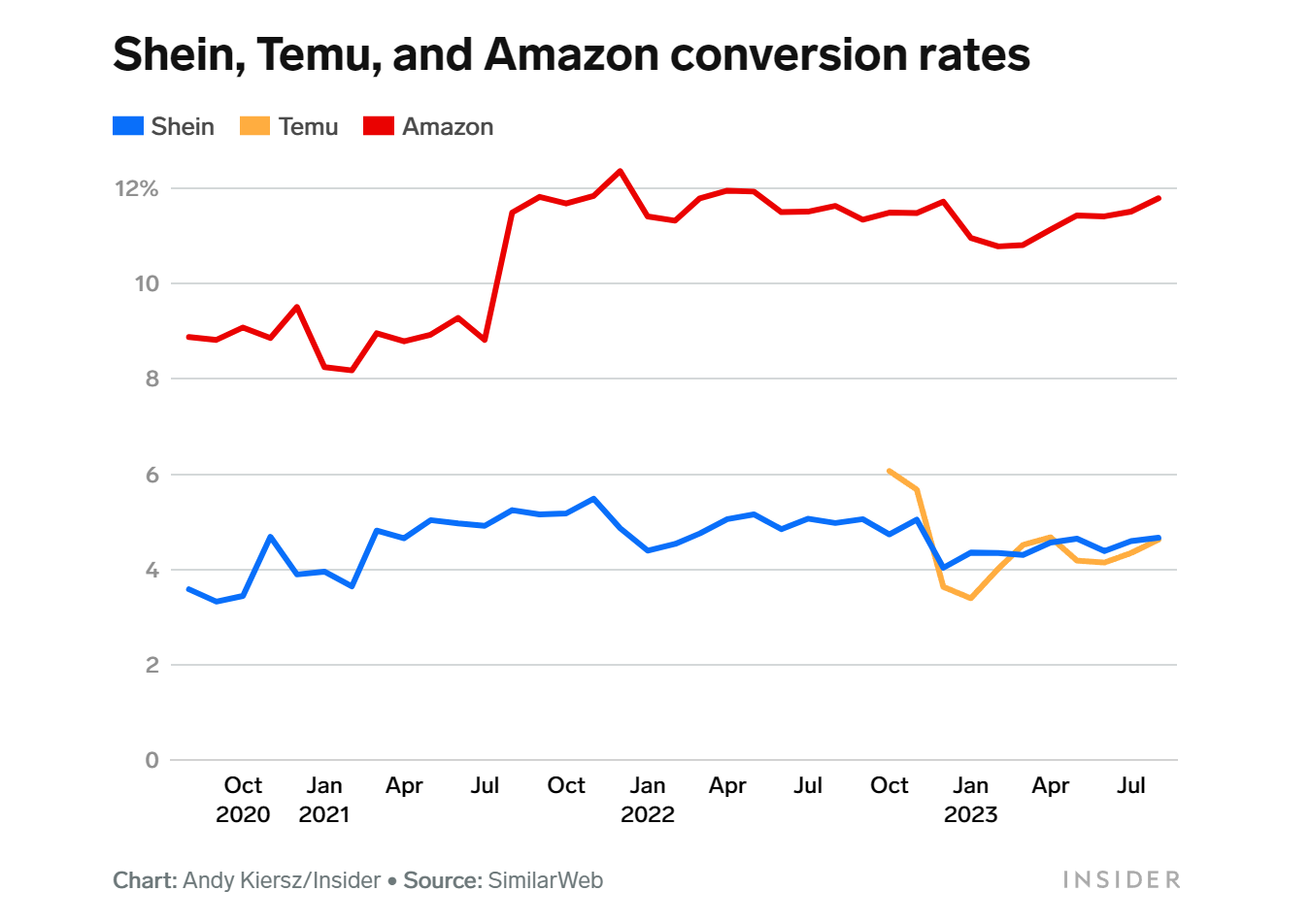

Temu and Shein have a long way to go to overtake Amazon in the e-commerce space. According to Similarweb, 93% of users who visit Temu also use Amazon, while 8% of Amazon users also use Temu. Amazon’s conversion rate is nearly 12%, compared to Shein and Temu’s conversion rate of about 5%.

On the other hand, Shein and Temu also lag far behind Amazon in terms of conversion rates (i.e., the percentage of visitors to a store’s webpage who actually make a purchase), with Shein and Temu’s conversion rates at around 5%, compared to Amazon’s close to 12%.

UBS analysts believe that Shein and Temu will not pose too much danger to other established e-commerce platforms in the United States. Because, there are many users accused of Temu’s shipping speed is too slow, there are some consumers on Shein such as “ultra-fast fashion” is full of questions about environmental protection.