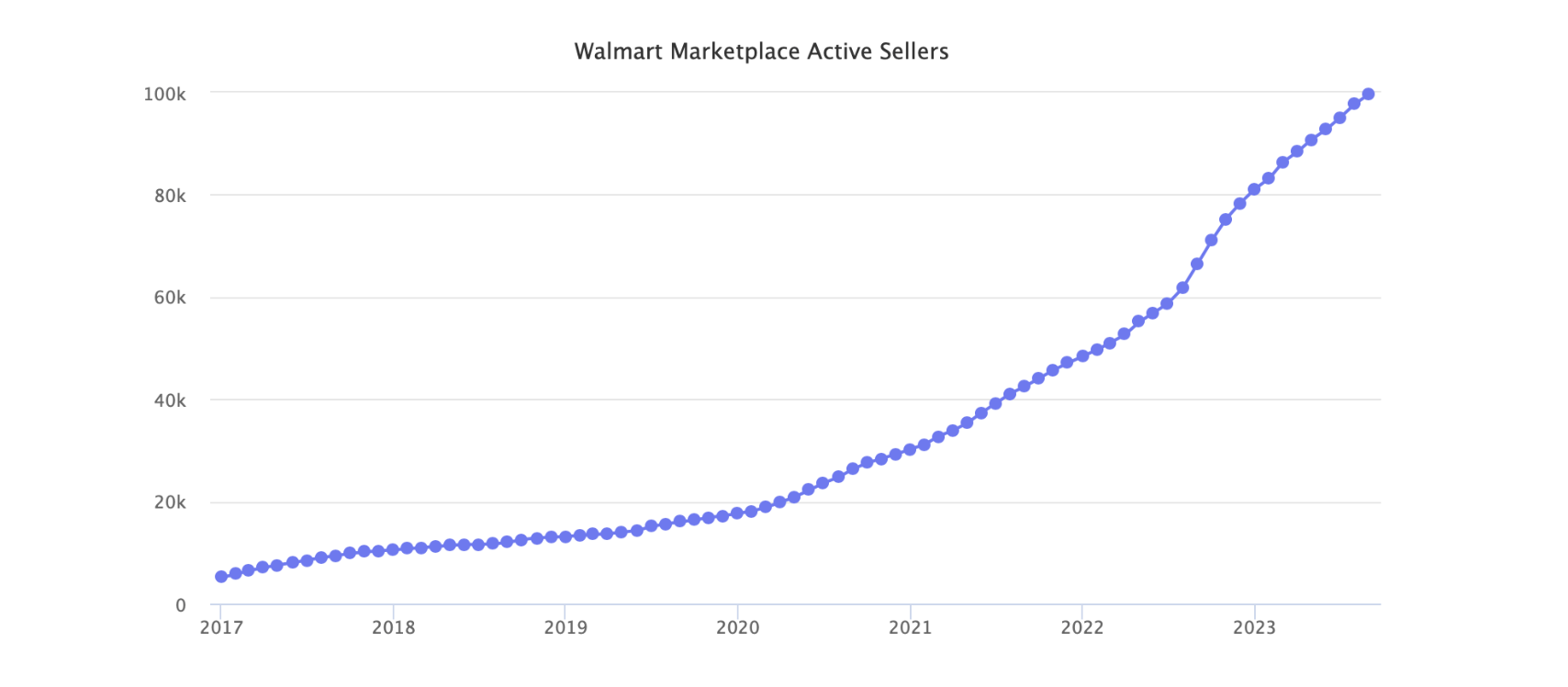

YCD News – Walmart’s third-party marketplace has doubled in size over the past 18 months, according to new research from Marketplace Pulse. To date, the platform has surpassed 100,000 active sellers. Over the past year, 10,000 to 20,000 sellers have applied to join Walmart each month, with about 10 percent of sellers ultimately approved and active by Walmart.

Walmart liberalized registration for international sellers in March 2021 and attracted a large number of Chinese sellers at that time. However, since April of this year, the trend has reversed. Walmart recently said that now, most new sellers are from the United States. It still allows international sellers to apply to move in, but for some reason their numbers have shrunk significantly.

Walmart.com currently sells more than 400 million products, 95% of which come from third-party sellers.Marketplace Pulse notes that Walmart’s sales growth will remain steady going forward based on the breadth of the Walmart platform’s product catalog and the sheer size of its third-party sellers. That said, doubling the size of the marketplace and the number of SKUs will not result in doubling GMV.

Going forward, integrating third-party marketplaces with the broader Walmart ecosystem is key. Over the past few years, Walmart has managed to get most sellers to use Walmart Fulfillment Services (WFS) for delivery. According to John David Rainey, Walmart’s CFO, the number of sellers using WFS grew by 50% in the second quarter of 2023. Like Amazon and Amazon Logistics, Walmart’s platform business is closely tied to delivery services.

Walmart’s unique advantage in online sales comes from its offline stores, which help it fulfill 50% of its order deliveries. Walmart is known to be combining its online and offline businesses in order for brands to end up on Walmart’s physical shelves, which is a key move in Walmart’s marketplace strategy. For years, Walmart’s growth came from adding sellers. But now, growth must come from integrating platform features and empowering sellers.